Cartography: Zhang Fangman

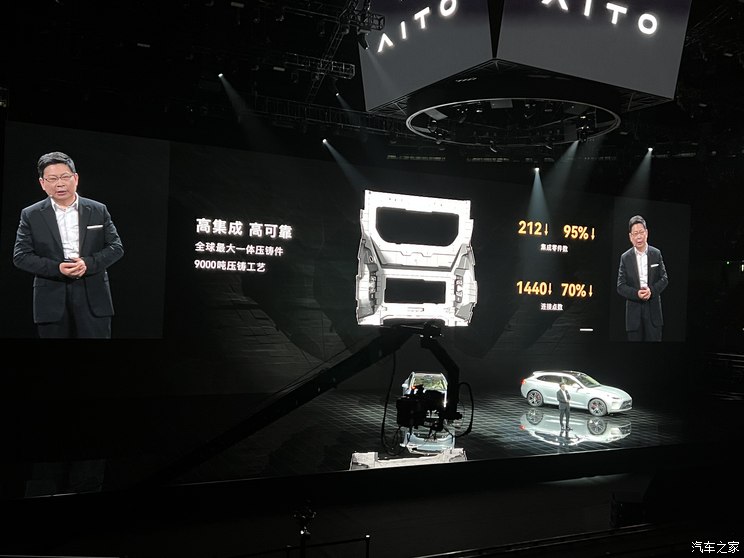

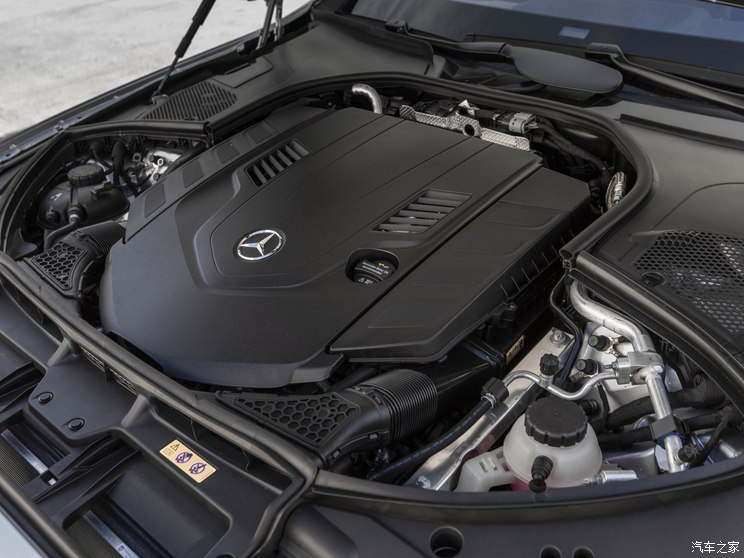

In the vast desert, soldiers were stationed on the battlefield. At the grand military parade held at the Zhu Rihe Joint Training Base not long ago, nearly 600 sets of engines, including turbofans, turbojets, turboshafts and turboprops, two types of auxiliary power devices and two types of transmission systems developed and produced by China Aviation Engine Group participated in the review.

The collective appearance of the "heart" of these aviation equipment is inspiring. At present, seven series of aero-engines, auxiliary power devices and transmission systems have been widely installed on various military aircraft and helicopters in China. More people are concerned, when will China’s independently developed large aircraft be able to use the independently developed "China Heart"? What are the breakthroughs and difficulties in the development of aero-engines in China? With these questions, the reporter conducted an interview.

How is the development going?

Improve manufacturing efficiency and strive to achieve "parallel running" in about 20 years.

Aero-engines play a decisive role in the whole aviation industry, are the "heart" of aviation weapons and equipment to ensure national security and show the status of a powerful country, and are also an important driving force for the development of civil aviation. Moreover, because of the long industrial chain involved and wide coverage, they have a huge driving effect and industrial radiation effect on the development of basic industries and science and technology.

Different from previous years, the aero-engine development has been done quietly. At present, the "two engines" project of aero-engine and gas turbine has been included in the 100 major projects and projects planned to be implemented in China in the "Thirteenth Five-Year Plan" and ranked first. It is imperative to develop China’s own aero-engine. On August 28th last year, China Aviation Engine Group, which was jointly funded by the State Council, Beijing Municipal People’s Government, aviation industry corporation of china and China Commercial Aircraft Co., Ltd., came into being, raising the innovation and development of aviation engines to the national will.

What progress has been made in aero-engine development in the past year? The reporter learned that in the first half of 2017, the delivery rate of new aero-engines in China increased significantly, which was 8 percentage points higher than that in the first half of last year. When the output of a key model product increased by 34%, the year-on-year product delivery rate increased by 10 percentage points.

In addition to the improvement of manufacturing efficiency, the reliability and quality of aero-engine products have also been steadily improved. Li Ping, director of the Production and Supply Chain Office of China Hangfa Production Department, said: "At present, the product field integrity rate is above 90%."

At present, the scientific research tasks of China Hangfa are full: there are several engines, auxiliary power units and gas turbines.

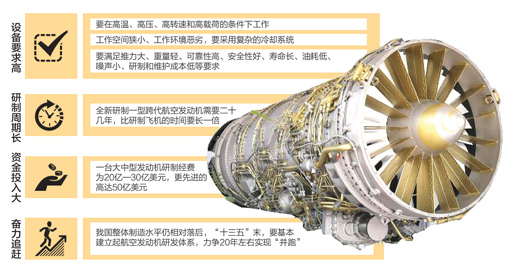

Dry aero-engines, when can China "run" or even "lead" with the world advanced level? It is understood that the countries that can build aero-engines in the world are the five permanent members of the UN Security Council. Although China ranks among them, its overall manufacturing level is relatively backward. "Strive to achieve it in about 20 years ‘ Run side by side ’ 。” Cao Jianguo, Party Secretary and Chairman of China Hangfa, explained that everything is difficult at the beginning, and so is the engine. We must finish one or two or three models and go through a complete R&D process to form a complete system of design, manufacturing, testing and talent team, and then develop new models. There is a foundation. "The products independently developed by the first generation may not be advanced, but we will continue to work on the second and third generations, or we may become advanced, increasing with generations.

What is the difficulty in current development?

The biggest shortcoming is the engine design, and the magic weapon for winning is the "national system"

According to statistics, it takes more than 20 years to develop a new type of trans-generation aero-engine, which is twice as long as that of the same generation aircraft. It can be said that it is the most complex and multidisciplinary engineering machinery system in the world today, and it is known as "the pearl on the crown of modern industry". Picking the pearl is extremely difficult.

First of all, the aero-engine should meet many demanding and contradictory requirements: it should not only work under the harsh conditions of high temperature, high pressure, high speed and high load, but also meet the requirements of large thrust, light weight, high reliability, good safety, long life, low fuel consumption, low noise and low development and maintenance costs. For example, at present, the average on-board life of civil aviation engines should reach more than 20,000 hours, and if they fly for 6 hours every day, they can be used for 10 years.

Secondly, the operating space of aero-engine is narrow and the operating environment is harsh, which puts forward higher requirements for design, manufacture and test. A turbofan engine for supersonic fighters is generally only about 1 meter in diameter and 4 meters in length. Such a small cylindrical object has to be stuffed into more than ten stages of fans, compressors, turbines, combustion chambers, afterburner and other components. What’s more serious is that the temperature of the engine combustion chamber and turbine is very high, reaching 1600— At 1700 degrees Celsius, the temperature in the afterburner is as high as 1800— 1900 degrees Celsius, while the highest tolerance temperature of superalloy materials at present is only 1100 degrees Celsius. Therefore, it is necessary to adopt a complex cooling system in the engine and set a labyrinth-like cooling channel.

Great technical difficulty also brings huge investment demand. The development cost of a large and medium-sized advanced engine is 2 billion-— 3 billion dollars, more advanced up to 5 billion dollars.

Among all the difficulties, where is the biggest shortcoming?

"The biggest shortcoming is design." Yin Zeyong, director of China Aerospace Science and Technology Committee and academician of China Academy of Engineering, said frankly that we often say that aero-engines have a long development cycle and large capital investment because they are not only designed and manufactured, but also tested and flown. But only by strengthening the design can we reduce "experiments — Modify the design — Remanufacturing — In the process of trial and error, the backward design ability is the main factor restricting the development of aero-engines in China, which prolongs the research and development cycle.

Lack of standards and accumulation is also a big shortcoming. "To build an aero-engine, in addition to the craftsman spirit, there must be a set of standardized design criteria." Yin Zeyong said that the parts that can be made by masters cannot be made by ordinary employees, and the technical reliability is weak. Wang Yingjie, director of the Management Innovation Division of the Quality and Technology Department of the Group, said that the core secret of the world’s advanced engine manufacturers is hundreds of sets of design and manufacturing guidelines. They have accumulated a set of standard systems with years of R&D and manufacturing experience. "In this respect, we still have a big gap."

Make up the short board, and the airman is very confident. In their view, the magic weapon to win is the "national system" and the development mechanism of "small core and big cooperation". "China Hangfa is a state-owned super-large enterprise managed by the central government and the only aero-engine development enterprise in China. Its birth itself shows that it is necessary to engage in aero-engines with the power of the whole country." Luo Ronghuai, deputy secretary and general manager of China Hangfa Party Group, said that the state has provided a strong institutional mechanism and financial guarantee for the development of Hangfa industry. "Relevant enterprises have given their full support, and some central enterprises have produced special steel products for us, but the demand is very small, and losing money also supports us." "Industry-University-Research has close cooperation, and our enterprises have established common basic research platforms with universities and Chinese Academy of Sciences to carry out technical research and frontier technology exploration" … …

How to climb the hill in the future

Information technology means grasping design, and basically establishing an aero-engine R&D system at the end of the "Thirteenth Five-Year Plan"

What should China aero-engine do in the future?

"At present, the first thing to grasp should be design, otherwise it will be difficult to catch up with the world advanced level." Yin Zeyong said.

To do a good job in design, we should not only establish standards and solidification processes, but also make good use of information means. Yin Zeyong, for example, used computers to realize three-dimensional design drawings in the design process; The simulation link should be simulated by using three-dimensional information platform, and the design scheme should be simulated and installed in the computer to see if there is interference between the systems and the assembly sequence is correct; In the manufacturing process, the three-dimensional information of the engine should be transmitted to the factory, and the workshop workers use the three-dimensional model to directly manufacture and process.

From the top-level design, China will basically establish an aero-engine R&D system at the end of the 13th Five-Year Plan. Wang Yingjie introduced that China Hangfa is building a complete set of operation management system, including product research and development, manufacturing, supplier management and service guarantee, in which product research and development system is at the core, and independent research and development and manufacturing criteria should be accumulated through system construction in the future.

"This system is currently ‘ Bones ’ It’s put up, but it needs to be full ‘ Flesh and blood ’ 。” Wang Yingjie said. For example, the product development stage should provide a technical definition for the development of the whole engine life cycle; In the manufacturing process, the application of advanced management methods such as lean manufacturing and intelligent manufacturing should be realized; Supplier management should not only abide by the rules of market economy, but also strengthen macro-control at the group level; The service guarantee link must not only meet the use demand of weapons and equipment, but also realize the value-added service.

At the same time, China Hangfa will strengthen the independent research and development of civil engines that started late, and strive to make civil aircraft such as C919 use "China Heart" as soon as possible.

Since 2017, China Hangfa has implemented the "casting heart" project in the whole group. Heart, not only represents the engine is the heart of aviation power, but also represents the concerted efforts of aviation developers. The hard power of the former cannot be separated from the soft power of the latter. Chang Longshu, Party Construction Department of China Aviation Development Party Group Work Department, said that the improvement of new aircraft delivery rate and the shortening of manufacturing cycle can not be separated from the "casting heart" project that gathers wisdom and strength, and will keep in mind the mission and wholeheartedly support the "China heart" of aviation power in the future.