The first explosion in the fourth quarter of 2023It’s coming.

On the first trading day after the National Day, A shares rose less and fell more as a whole.It once fell more than 1.2% in intraday trading, and the closing decline narrowed to 0.44%. Northbound funds resumed trading at 14: 00, with a net sale of 7.46 billion yuan throughout the day.

The overall turnover of A shares was sluggish, with only 3 shares exceeding 5 billion yuan, namely、、.

The leader of the trackThe turnover was 6.618 billion yuan, and the stock fell 3.71% today. The intraday share price hit a two-year low. The latest A-share market value was less than 860 billion yuan, and the closing price retreated 48.74% from the historical high.

Satellite communication concept leaderThe intraday price once rose over 17%, and the stock price reached a record high. At the close, the stock price fell sharply, and the increase narrowed to 3.9%.

, aquatic products, prepared vegetables, pork,And other themes fell sharply. The index fell the most, and the concept stocksDown limit,、、、、Such as falling more than 6%.

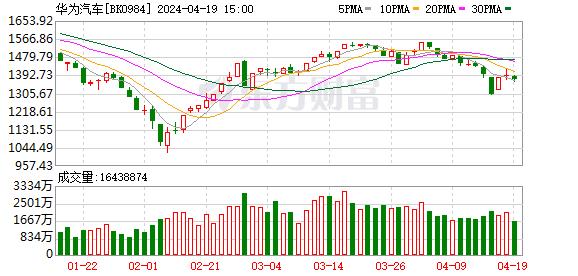

With cars,Related themes are strong against the market. One of the most eye-catching is thatConcept, index increase is far ahead in the A-share theme sector.、、、、、6 shares gain a 20cm daily limit.

Today’s direct daily limit, the stock is both,、, cars and other themes, realized in the first half of this year.69 million yuan, down 15.27% year-on-year.

Huawei asks for new M7 orders.

In the news, in the past Mid-Autumn National Day holiday, the new M7 in the world has become a dark horse in the automobile market, and the amount of large deposits (generally referring to reservations and non-refundable deposits) has hit record highs.

On October 7, Huawei andThe AITO brand jointly developed announced that the number of new M7 models has exceeded 50,000. From September 12th to October 6th, in just 25 days, the average daily increase in the number of large enterprises in the industry was close to 2,000.

In an interview in early 2023, Yu Chengdong had confirmed that Huawei BU would achieve the goal of profitability in 2025. M7 has undoubtedly boosted Huawei’s BU business in terms of market realization. As of August 30, 2023, the cumulative sales volume of the industry this year was only 35,200 vehicles. In other words, the single product pulling effect of the new M7 has been greater than that of the previously released M7, M5 and M5 EV.

existAs mentioned in the article, Mate 60/Mate X5 series has driven Huawei’s popularity to rise unprecedentedly, and the price of new cars has exceeded expectations (249,800-309,800 yuan, 60,000-70,000 yuan lower than the main competing products), as well as the improvement of product strength such as safety, which has led to the surge in the number of shops and orders. It is expected that the monthly sales of brands driven by M7 will return to the ranks of 10,000 vehicles.

It is said that in September, the state proposed to stabilize the consumption of fuel vehicles, which is conducive to the recovery of the low-end auto market and further stabilize consumption; The superimposed auto show will drive the new car listing boom, and the product strength of the model is expected to gradually improve. The "Golden September and Silver 10" auto market is expected to exceed the expectations at the beginning of the year.

Two funds are eyeing these concept stocks.

In the A-share market, more than 100 companies directly or indirectly participate in the industrial chain. As of October 9, the total market value of Huawei’s auto concept stocks A shares was about 1.45 trillion.Since the beginning of this year, Huawei’s auto concept stocks have risen by an average of 23.12%, significantly outperforming the Shanghai Composite Index in the same period.

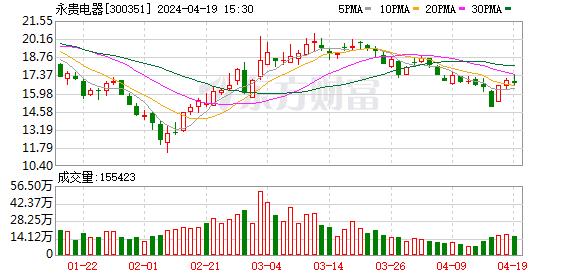

In terms of funds, some stocks have been acquired recently., financing funds to add positions. According to the statistics of data treasure, according to the average transaction price of the interval, there are 6 Huawei auto concept stocks that have increased their positions by more than 100 million yuan since September, namely、、、、、. In the same period, there were also 6 net purchases of financing exceeding 100 million yuan, namely、、、、、.

fromIn terms of growth potential, according to the unanimous prediction of more than five institutions, there are 19 concept stocks whose net profit growth rate is expected to exceed 30% this year and next.

Of these 19 shares, 4 have a rolling P/E ratio of less than 30 times, including、、、. Compare with that target price predicted unanimously by the organization,、、、、、The upside is over 30%.

The upside is 81.21%, ranking first. GuoshengThe research report believes that Xiangxin TechnologyStructural parts are expected to cooperate with Huawei,Wait, the incremental supporting potential is great; In the first half of 2023, the new fixed-point amount is expected to be 28 billion to 28.5 billion yuan, and the orders in hand are full; With the release of the company’s production capacity, the future growth can be expected.

关于作者