On June 24th, Ren Zhengfei, the founder of Huawei, said in an exclusive interview with the Financial Times that HSBC knew about SKYCOM and its business in Iran from the beginning, and also knew about SKYCOM’s relationship with Huawei. It is impossible for a bank to legally say that it has been cheated and doesn’t know about this matter. The evidence is all there, and this is inescapable. "HSBC has stopped all our trading cooperation, not us." Ren Zhengfei said.

The evidence against Meng Wanzhou in the United States is a PPT. What does Ren Zhengfei think of how the United States got this PPT? On June 27th, Ren Zhengfei said in an interview with Canada’s Globe and Mail that because Skycom had been in contact with Huawei from beginning to end during the trade with Iran, the bank knew about Skycom’s business in Iran and its relationship with Huawei. After several years of operation, they invited Meng Wanzhou to a coffee shop. When having coffee, Meng Wanzhou gave some PPT, which was not misleading. "Why did the bank take these PPT? We don’t know, I hope that after the trial of the Eastern District Court of new york is completed, we can be more clear. " Ren Zhengfei said.

According to the Global Times, in February this year, Reuters reported that HSBC had obtained a material for the US Department of Justice to sue Huawei through an "internal investigation", which helped the US Department of Justice Luo Zhi with the "crime" of attacking Huawei, and eventually led to the arrest of Huawei executives in Canada.

Shen Yi, an associate professor in the Department of International Politics of Fudan University, said that if the foreign media reports are true, the role played by HSBC in this matter is indeed very problematic. Such banks and financial institutions are unreliable and unreliable in a sense.

An expert who wishes to remain anonymous said that the essence of this case is that HSBC cooperated with the "long-arm jurisdiction" of the U.S. government, and transferred the personnel and data located in China overseas without the permission of the China government for the cross-border investigation and evidence collection of Huawei by the U.S. Department of Justice.

It is reported that HSBC is one of the largest banking and financial services institutions in the world. Founded in Hong Kong and Shanghai in 1865, HSBC is a founding member of HSBC Group and its flagship in the Asia-Pacific region. In 1991, HSBC established a new holding company — — HSBC Holdings Limited, and in 1992, it completely acquired Midland Bank. Subsequently, HSBC will be headquartered in London.

HSBC will pay a fine of $1.9 billion to the United States on money laundering charges. On December 11, 2012, HSBC announced that it had reached a settlement agreement with the US government, and would pay a sky-high fine of $1.921 billion for the bank’s ineffective prevention of money laundering.

HSBC’s image has been damaged in recent years. In November 2014, HSBC was fined $618 million by the UK Financial Conduct Authority and the US Commodity Futures Trading Commission for manipulating the global foreign exchange market. In February 2015, HSBC was once again caught in a scandal because it helped customers evade taxes. According to a survey by the American Association of International Investigative Journalists, from 2005 to 2007, HSBC Switzerland Branch helped 100,000 heavyweight customers to avoid taxes and hide assets as high as hundreds of billions of dollars.

It is worth noting that HSBC has exposed four major incidents of leaking customer information. On April 26th, 2008, the server of Kwun Tong Branch of Hongkong and Shanghai Banking Corporation was stolen during the renovation, and nearly 160,000 customer data were lost. In July, 2008, HSBC said that it lost an encoded digital audio tape, which recorded the telephone conversation between the bank and its customers, and was a backup tape containing 25,000 telephone conversations. On April 13, 2010, the French prosecutor said that 127,000 accounts of 79,000 customers of HSBC were leaked and exposed. Jelf farsi Yani, a former IT consultant of HSBC Private Bank, a Swiss subsidiary of HSBC, was accused of stealing the data of tens of thousands of bank customers from the end of 2006 to the beginning of 2007. In 2018, HSBC was exposed that its customer accounts were attacked from October 4 to October 14, and the personal information of about 1% American customers was leaked.

HSBC Bank (China) Co., Ltd. (hereinafter referred to as "HSBC China") officially opened on April 2, 2007. Headquartered in Shanghai, it is a locally registered foreign-funded corporate bank wholly owned by HSBC.

In March this year, HSBC China Wuhan Branch violated the law and regulations by not using the specified subjects in the paper payment form. According to Article 41 of the Administrative Measures for Commercial Banks and Credit Cooperatives’ Acting Treasury Business, the Business Management Department of Wuhan Branch of the People’s Bank of China imposed a fine of RMB 1000 yuan.

In May this year, the post-event management of independent payment of HSBC China loan seriously violated prudent business rules, and part of credit card funds were used for non-consumption areas, which resulted in a fine of 1 million yuan.

Foreign media said that HSBC helped the US government "engage" Huawei in order to get rid of the crime.

According to the Global Times, recently, the Financial Times revealed that HSBC, which was targeted by the US Department of Justice for a series of problems such as money laundering and violation of the sanctions bill, agreed to "cooperate" with the investigation of the US Department of Justice in other cases in order to escape punishment. Huawei in China became the victim of this "cooperation", which eventually led to the arrest of Huawei executives. The Financial Times report also revealed that HSBC had explained to China earlier this year that it was "forced".

Regarding the role of HSBC in the case involving Huawei, Reuters, UK, had a detailed round of reports in February this year. According to Reuters’s report at that time, HSBC began to "cooperate" with the "investigation" initiated by the U.S. Department of Justice against Huawei from the end of 2016 to 2017, in exchange for the U.S. Department of Justice’s forgiveness for HSBC, because HSBC itself was involved in other cases that violated the U.S. sanctions ban.

Reuters said that through "internal investigation", HSBC helped the U.S. Department of Justice to obtain a material that could be used to sue Huawei, which helped the U.S. Department of Justice Luo Zhi to "accuse" Huawei, and eventually led to the arrest of Huawei executives in Canada.

The executive of Huawei, who is now detained by the Canadian government, communicated face to face with an executive of HSBC, saying that Huawei did not have any non-compliance and provided the HSBC executive with a PPT document to explain the situation. But what Huawei didn’t expect was that in 2017, when HSBC faced a lawsuit from the U.S. Department of Justice for its alleged illegal behavior, in exchange for forgiveness from the U.S. Department of Justice, HSBC handed over the PPT to the U.S. Department of Justice, which had been trying to bring down Huawei in the past few years, and ended its cooperative relationship with Huawei.

Judging from Reuters’s report and the indictment of the US government against Huawei, such a small PPT file was quickly used by the US Department of Justice as the "core" basis for suing Huawei and arresting the Huawei executive last year. HSBC has also been described by the U.S. Department of Justice as a "victim" of fraud by the Huawei executive and her PPT. Reuters also revealed that HSBC has never been sued by the US government for other cases involved.

The Financial Times also revealed some information that Reuters didn’t mention. For example, HSBC was targeted by the US Department of Justice as early as 2012 for laundering money for Mexican drug lords. At that time, in addition to paying a huge fine of $1.9 billion, the US Department of Justice also sent a group of "monitors" to HSBC to review its business. Insiders of HSBC said that their explanation at that time was that because the US government sent monitors to HSBC and a team of 200-400 people could get all the information of the bank at any time, it was impossible for HSBC to resist the request and investigation of the US Department of Justice.

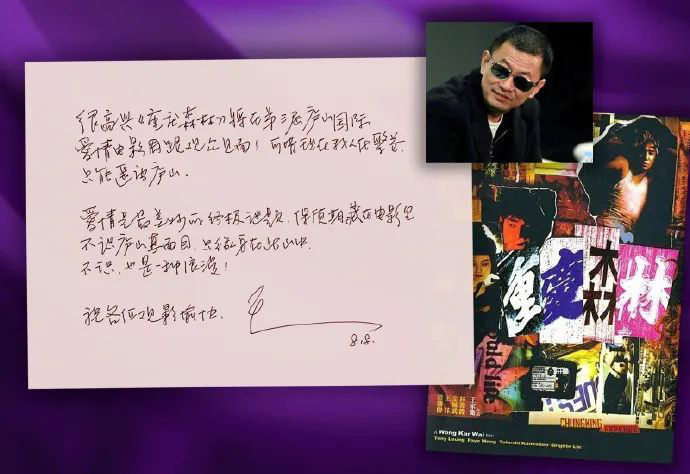

Ren Zhengfei: HSBC knows about Skycom’s relationship with Huawei.

Recently, Huawei Heartfelt Community announced the minutes of Ren Zhengfei’s interview with the Financial Times and the Canadian Globe and Mail.

James Kynge, a reporter from the Financial Times, asked: Recently, hearing about the cooperation between HSBC and the US government will bring great difficulties to Huawei. What do you think of the future cooperation between Huawei and HSBC?

Ren Zhengfei: First of all, HSBC has long stopped its cooperation with Huawei.

Second, Meng Wanzhou has no criminal facts. This bank knew about SKYCOM and its business in Iran from the very beginning, and also knew about SKYCOM’s relationship with Huawei. The mail can prove that there are shipping marks in the mail, and it is impossible for the bank to legally say that it was cheated and didn’t know about this matter. The evidence is all there, which cannot be relied on. Meng Wanzhou said a word while drinking coffee in the coffee shop, which can’t be the evidence of Meng Wanzhou’s crime. It’s just that during the long-term transaction with Iran from beginning to end for many years, she intervened to have a coffee in the coffee shop and said a word, there is no crime. American courts can investigate prosecutors, who report crimes in Meng Wanzhou. Where are the facts?

Under the current circumstances, we should first clarify the process of Meng Wanzhou’s incident and show all the evidence. Moreover, Meng Wanzhou has not committed a crime in Canada, and Canada has violated the law in law enforcement procedures. Canada is a country ruled by law, so it should give up its violation of constitutional rights and not fall on the side of the United States. If people don’t believe that Canada is a country ruled by law, it will have a greater impact on its image.

We have always trusted western countries ruled by law, focusing on facts and evidence. First of all, there must be facts and evidence to judge whether this person is wrong. Of course, this will not affect our cooperation with other banks in the future. After this link is solved, everyone will still cooperate. World finance is an integrated system.

"Financial Times" reporter Huang Shulin asked: HSBC does not cooperate with Huawei. Did they give you an explanation?

Ren Zhengfei: HSBC has stopped all our trading cooperation, not us. They didn’t explain, that is, they wouldn’t provide us with services, so we would cooperate with other banks.

Huang Shulin: Do you think this treatment is fair? If these problems are solved, will you continue to cooperate with HSBC in the future?

Ren Zhengfei: There is no word "fairness" in this world. It is all about strength. We have the strength to solve the problem and don’t care how the other party treats us. Now is not the time to discuss cooperation. The most important thing is to finish the lawsuit first.

A reporter from Canada’s Globe and Mail asked: What do you think of how the United States got this PPT? Is it through legal channels? Do you think this PPT can be presented to the court as evidence?

Ren Zhengfei: Because during the trade between Skycom and Iran, this bank has been in contact with Huawei from beginning to end. It knows Skycom’s business in Iran and its relationship with Huawei. After several years of operation, they invited Meng Wanzhou to a coffee shop. When having coffee, Meng Wanzhou gave some PPT, which was not misleading. Why did the bank take these PPT away? We don’t know. I hope we can know more after the trial in new york Eastern District Court.

HSBC paid a fine of $1.9 billion to the United States for money laundering charges.

According to Xinhua News Agency, on December 11, 2012, HSBC Holdings, the largest bank in Europe, issued a statement saying that it had reached an agreement with relevant US institutions to pay a total fine of 1.921 billion US dollars, of which a record 1.256 billion was a fine for delaying prosecution agreement and 665 million was a civil fine.

Ou Zhihua, president of HSBC, said in a statement that HSBC "admitted responsibility for past mistakes" and once again "deeply apologized".

According to the deferred prosecution agreement, the prosecution allows the sued party to avoid prosecution under certain conditions, including paying a fine or being punished, and promising to make specific reforms under the supervision and guidance.

HSBC said it had spent $290 million to improve its money laundering prevention mechanism and recovered some bonuses previously won by senior executives. The statement also said that HSBC expects to sign a letter of commitment with the UK Financial Services Authority on money laundering soon.

In July, 2013, china securities journal reported that Reuters reported on the 3rd that John Grayson, a judge of Brooklyn District Court in new york, USA, approved the settlement agreement reached between HSBC and the US government on the investigation of not fully complying with the anti-money laundering and sanctions laws. According to this agreement, HSBC will pay 1.92 billion US dollars in fines and compensation. The fine of $1.92 billion is by far the largest fine issued by the US regulatory authorities to banks.

According to the report, in addition to paying fines, there are other conditions to be met. As part of the agreement, HSBC also needs to restrain the bonuses of bank executives in order to comply with relevant regulations. In addition, HSBC will face up to five years of court supervision.

Previously, in July 2012, the US Senate issued an investigation report saying that HSBC had become the "preferred financial institution" for drug dealers, money launderers and other criminals in Mexico and Colombia, and it ignored the US sanctions against Iran, Myanmar, Cuba, Libya and Sudan and illegally transferred funds for customers in these countries.

HSBC’s image has been damaged in recent years: helping customers evade taxes and getting caught in a scandal.

According to China News Service, the image of HSBC has been damaged in recent years. In November 2014, HSBC was fined $618 million by the UK Financial Conduct Authority and the US Commodity Futures Trading Commission for manipulating the global foreign exchange market.

In February 2015, HSBC was once again caught in a scandal because it helped customers evade taxes. According to a survey by the American Association of International Investigative Journalists, from 2005 to 2007, HSBC Switzerland Branch helped 100,000 heavyweight customers to avoid taxes and hide assets as high as hundreds of billions of dollars.

According to the People’s Daily, the BBC reported on February 9, 2015 that HSBC, the largest bank in the UK, has done everything possible to help wealthy depositors hide their real assets from the British government in the past few years, with tax evasion amounting to hundreds of millions of pounds. Analysts pointed out that if acts such as helping depositors evade taxes are proved to be true, then HSBC will become a terrible "tax haven" and its reputation and prestige will be dealt a heavy blow.

Some analysts believe that the lack of financial supervision, the decline of professional ethics and the numbness of social responsibility are several key factors that cannot be ignored.

HSBC’s alleged behavior of helping depositors evade taxes has been strongly criticized by the media and public opinion. Brooks, the author of "Tax Robbery", pointed out, "I think HSBC is a tax avoidance and tax evasion company, and I think they are providing such services".

Since then, Guangming Daily reported on February 26, 2015 that two top executives of HSBC recently apologized here for the "improper" practice of their Swiss private banks to help customers avoid taxes. Stuart Gulliver, CEO of HSBC Group, and Douglas Flint, Chairman of HSBC Group, said when questioned by the Parliamentary Finance Committee in the British Parliament that this move damaged people’s "trust and confidence" in HSBC Group, and he was ashamed of it and would "take corresponding responsibility". However, he also accused those in the management of HSBC Swiss Bank who stole and leaked customer information of "great sin".

HSBC has exposed four major incidents of leaking customer information. Engineers turned into "data thieves"

According to Southern Metropolis Daily, on April 26th, 2008, the server of Kwun Tong Branch of Hongkong and Shanghai Banking Corporation was stolen, and nearly 160,000 customer data were lost. Under the pressure of public opinion, the Hong Kong Monetary Authority requires banks to take remedial measures and submit detailed reports. Zheng Haiquan, chairman of HSBC Asia Pacific, apologized for the loss of customer information, but he said that it was a theft and HSBC itself was a victim, but the bank would still be responsible. Zheng Haiquan said that he would review the bank’s security measures.

According to Economic Observer, on July 4, 2008, HSBC issued a notice and found that it had lost an encoded digital audio tape, which recorded the telephone conversation between the bank and its customers. According to reports, the incident originated from the service center of HSBC Guangzhou Group. On June 17, the courier company was entrusted to transport a total of 55 tapes to Hong Kong, but only 54 tapes were delivered to the Hong Kong office of the bank. The unrecovered audio tape is a backup tape containing 25,000 telephone conversations, which recorded the telephone conversations between the bank and customers and callers from April 18 to 24, 2008. Most of the contents involved credit card service inquiries, calls related to business online wealth management services for industrial and commercial customers, and calls made by the bank to customers.

According to Agence France-Presse, on April 13, 2010, the French prosecutor said that 127,000 accounts of 79,000 customers of HSBC were leaked and exposed, which means that more people may be prosecuted by the tax bureau of their own country for alleged tax evasion. Jelf farsi Yani, a former IT consultant of HSBC Private Bank, a Swiss subsidiary of HSBC, was accused of stealing the data of tens of thousands of bank customers from the end of 2006 to the beginning of 2007.

Jelf Fasiani changed from a security engineer to a "data thief". He was born in Monaco and has a degree in computer programming. In 2000, at the age of 28, he entered the IT department of HSBC and wrote security software for the bank. Six years later, he was transferred to the Geneva headquarters of HSBC Private Bank in Switzerland, responsible for the system security of the database. In 2008, this system security engineer, who has always performed well, unexpectedly "ran away" from the headquarters building of HSBC with 130,000 "top secret" customer information. In 2013, according to Jinling Evening News, at the trial of Spanish National Court in 2013, Jelf Fasiani defended himself, saying that banks were corrupt, and they condoned tax evasion, and sometimes even helped customers to launder money. He admitted that he had tried to expose HSBC’s "misconduct" to the Swiss government.

Jelf Fasiani told the media, "I grew up in Monaco, where people wanted to work in financial institutions. When I was young, I thought that banks were places to protect the property of the upright. But at HSBC, I found that everything is completely another matter. "

In November 2018, according to the China Business News, it was revealed that HSBC’s customer accounts were attacked from October 4 to October 14, and the personal information of about 1% American customers was leaked. According to foreign media reports, on November 8, HSBC announced that its customer accounts were attacked from October 4 to October 14, and about 1% of American customers’ names, birth dates, telephone numbers, email addresses and other information were leaked. According to HSBC, the hacking incident was caused by a login voucher attack, that is, hackers invaded HSBC accounts through personal information of customers obtained from other sources. In response, HSBC suspended online access to some accounts. At the same time, additional security protection is added to the authentication process of personal online banking platform to protect its customers from future attacks.