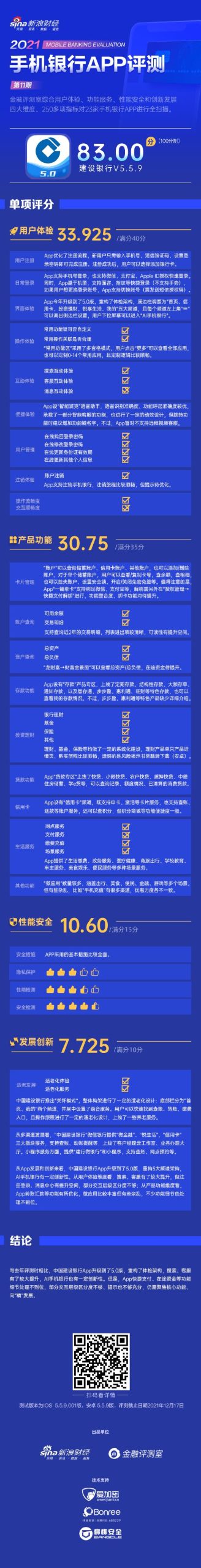

Sina Financial Evaluation Room comprehensively scanned the mobile banking App of China Construction Bank in four dimensions: user experience, product function, performance and safety, and innovation and development, with more than 250 sub-indicators, and finally gave 83.00 points (out of 100).

Compared with last year’s evaluation, China Construction Bank’s App has been upgraded to version 5.0, and the physical examination framework has been reconstructed, and the search and customer service have been greatly improved. AI mobile banking is also innovative. However, the functional details such as App fast payment and funds in transit are not handled in place, and some interactive levels are not well differentiated and the tips are not sufficient. It is still necessary to focus on the core functions and develop to "fine".

Compared with last year’s evaluation, China Construction Bank’s App has been upgraded to version 5.0, and the physical examination framework has been reconstructed, and the search and customer service have been greatly improved. AI mobile banking is also innovative. However, the functional details such as App fast payment and funds in transit are not handled in place, and some interactive levels are not well differentiated and the tips are not sufficient. It is still necessary to focus on the core functions and develop to "fine".

User experience (33.925 points /40 points): search and customer service have been greatly improved, and some interactions need to be optimized.

In terms of registration, China Construction Bank App has optimized the registration process. New users only need to enter their mobile phone number, SMS verification code and set their login password to complete registration. After successful registration, users can choose to add a bank card, and the process of adding a card is clear, and OCR is supported to identify the card number, ID card information and so on.

In terms of login, China Construction Bank App supports mobile phone number login, and also supports fast login authorized by WeChat, Alipay and Apple ID. At the same time, the App is based on the model, and supports quick login such as face and fingerprint (gestures are not supported), and switching is more convenient. If the user wants to change the login account, the App supports switching accounts; If the user forgets the password, the App supports online retrieval.

It is worth noting that the App registration and login system distinguishes between the contracted version and the non-contracted version. The non-contracted version can be opened through the above process, but transactions such as transfer cannot be made, and additional contracts need to be made at the counter or through the online banking shield. In addition, the contracted version can log in on two devices, and the non-contracted version can only log in on one device, so the overall strategy is conservative. In particular, users who sign up for mobile banking will become non-sign-up versions if they re-register, which is not the mainstream practice in the industry (there are also many peers who support remote video customer service to open transfers, etc.).

Compared with last year’s evaluation, China Construction Bank App has been upgraded to version 5.0 this year, and the physical examination structure has been reconstructed. The bottom column is adjusted to five channels: "Home Page, Credit Card, Investment and Wealth Management, Enjoy Life, Myself", and the "≡" in the upper left corner of each channel can be called out to make relevant settings. It is worth mentioning that users can conduct "AI mobile banking" by pulling down the screen on any channel, and the interactive architecture of operating system breaks the convention and is innovative to some extent.

Specifically, the "home page" is divided into "navigation, top function, account, common function, promotion map+10 recommended floors" from top to bottom. Among them, the "Common Function Area" adopts the multi-grid mode, and users can click "More" to view all applications or customize 0-14 common applications, and the customization logic is smooth. However, the text descriptions of individual application keys (icon) are too long and there is room for optimization; At the same time, it is suggested to increase the search for functions on the "All Applications" page. Many users have the habit of searching for functions on this page.

Another important channel "My" has also been restructured, and you can view personal information, rights and interests, assets and so on related to "Me". But it is a pity that users can’t see how many bank cards they have at a glance.

In terms of search interaction, all five channels of China Construction Bank App have search portals, which can view historical searches, popular recommendations and hot search lists, and support global search on functions, products, life, news and frequently asked questions. Fuzzy search has a good matching degree, and the search results are sorted and listed clearly; When users are dissatisfied with the search results or can’t find the results, they can link intelligent customer service (and bring in search keywords). Unfortunately, the search for activities can be improved.

In terms of customer service interaction, the "smart assistant" customer service entrance can be found in all channels of China Construction Bank App, and the customer service coverage of important function contacts is relatively high. "Intelligent Assistant" integrates the functions of guessing what you want to ask and hot spots, and "+"integrates frequently asked questions, telephone customer service and clearing records, but "Guess what you want to ask" has room for improvement in the matching degree of entering contacts. Compared with last year’s evaluation, the intelligent customer service has improved: ask questions → reply → satisfied/dissatisfied, and "dissatisfied" prompts to consult "Xiaowei’s teacher"; Users can also transfer to manual service by inputting keywords such as "artificial"-the number of people waiting will be prompted when accessing, expressions/pictures can be sent in the service, and evaluation can be made after the service.

In terms of message reminder, China Construction Bank App "Message" integrates account change, to-do reminder, system announcement, service notice, life discovery, financial information, etc., and can classify top/empty messages. Every transaction of the user, the App will pop up a window prompt, and each notification is more readable. However, there is still room for improvement in "Messages": First, the reading experience of the "Messages" homepage needs to be improved, and all kinds of messages such as account changes and system announcements are displayed by default, and each type of message has different styles, which is slightly confusing together; Second, the overall setting logic needs to be improved, the message home page is the same as the "…" level of all kinds of messages, and the logic of message service customization is also somewhat confusing; Third, the logic of smart calendar/to-do reminder is general.

In terms of convenient interaction, China Construction Bank App is equipped with "Smart Bank" voice assistant, which has excellent voice recognition accuracy and function calling accuracy. It carries some functions of intelligent customer service, and has also carried out some dynamic design. However, it is suggested to add the name of function keys when jumping functions. However, the App does not support remote video customer service for the time being.

In terms of user management, China Construction Bank App "My → My Information" supports updating the validity period of the certificate and modifying personal information such as occupation and address; "My → Other" supports the maintenance of receiving address, invoice information, etc. In addition, the "Security Center" supports the modification of login password and cancellation of mobile banking (the cancellation journey is smooth, but there is room for optimization of relevant tips).

In terms of interactive experience, users can find common operations such as transfer and remittance, my account, etc. on the homepage, and the common operations have been properly interacted. When the user’s journey is blocked, the App will prompt the reason for the blockage and give the error code. In some cases, the customer service can be linked to give a certain solution. However, some interactions of App are not smooth enough, and the prompts are not sufficient, so there is still room for improvement: First, apart from message settings, the interaction levels such as adding accounts and setting transfer limits are not clear enough, and the experience is not smooth enough. Taking adding an account as an example, "account" is divided into three levels: savings account, credit card and other accounts, and the corresponding account services at each level are different, but users need to make a choice again no matter which level they add an account. Similarly, "transfer setting → transfer limit setting" should point to the transfer limit, instead of selecting the personalized limit again.

Second, some tips are not sufficient. For example, when signing up for mobile banking, users need to use the digital password set by the counter, but the App tip "unified login password" is not clear enough; Terms such as "customer information modification" also need to be optimized from the user’s point of view.

Thirdly, the interactive architecture of "micro-application" is relatively unified, but the interactions such as accommodating business and integral mall can still be optimized.

Compared with last year’s evaluation, China Construction Bank’s App has been upgraded to version 5.0, and the physical examination framework has been reconstructed, and the search and customer service have been greatly improved. AI mobile banking is also innovative. However, there is room for improvement in App registration and message center, and some interactions are not smooth enough and tips are not sufficient.

Product function (30.75 points /35 points): There are many kinds of investment products, and many functional details are not handled in place.

In account management, China Construction Bank App "Accounts" can query savings accounts, credit card accounts and other accounts, and can also add/delete accounts. For a single savings account, users can view/copy the card number, check the balance, find out the details, report the loss of the account, set a security lock, and turn on/off the confidentiality exemption and visa exemption. It is worth noting that the App’s "one-click card binding" supports the binding of WeChat, Alipay, China Unionpay Quick Pass, etc., and the unbinding needs to be carried out in "authorization management → quick payment unbinding", and the functional integration and card binding function need to be improved.

Specific to "account details", the App supports querying the transaction details in the past two years. The entry and exit items in the detailed list are relatively clear, but there is room for improvement in readability-there is no opponent in the "transfer" in the list, so you need to click further to view the details; Support filtering by time, transaction amount and revenue and expenditure categories (still not subdivided enough), and also support keyword search.

At the same time, the "Dragon Wealth → Wealth Panorama" can view the total assets/liabilities, with comprehensive statistical categories and profit and loss reference, but the capital construction in transit needs to be optimized. In addition, "Dragon Fortune" integrates wealth management services such as wealth physical examination, this month’s income and expenditure, and wealth information.

In terms of transfer and remittance, China Construction Bank’s App "Transfer and Remittance" supports bank card transfer and mobile phone number transfer (both of which are functionally integrated), as well as reservation transfer and transfer from other banks. You can also view transfer records, manage the payee list and set transfer limits. Among them, "Transfer Record" supports detailed query in the past year, and also supports search by account name/account number/mobile phone number/postscript; Payee List can search for payees by name/account number/bank name/alias, and can also add/edit/delete payees, but the search results can be optimized, and the same account only needs to be hit once.

In terms of fast transfer method, App supports the recent payee’s fast transfer, copying the card number to open the App to induce transfer, and also supports batch transfer and QR code transfer, and can switch multiple verification methods according to the risk level. It is worth noting that recently, the payee can include the mobile phone number transfer record, but the dynamic interaction of sliding left and right affects the efficiency, and the more commonly used operations, the more simple and quick interaction is needed.

In terms of investment and financial management, the China Construction Bank App has an "Investment and Financial Management" channel, with the "total wealth management assets" displayed at the top and the "7+1" eight-grid mode at the bottom. Users can click "All" to view all investment products, including fund investment, wealth management products, gold accumulation, precious metals in accounts, insurance, deposits, securities services, bond investment and futures asset management products. However, the construction of "total wealth management assets" still needs to be improved, especially the inclusion of deposits is lagging behind.

Specific to large-scale investment products, financial management, funds, insurance, etc. have been systematically built. Among them, wealth management products include self-operated and consignment products (supporting screening and search), and the details page of a single product and the purchase journey are relatively smooth (with income calculator). Unfortunately, the risk disclosure book needs to be downloaded (Android); The types of fund investment products are also rich, and the product details page and purchase journey are smooth. You can check the position, and have income analysis and expiration reminder, but the processing of in-transit transactions needs to be optimized.

In terms of deposits, the China Construction Bank App has a "deposit" product area, which includes time deposits, structured deposits, large deposit certificates, notice deposits, and special deposits such as Smart Deposit, Bubuging, Huilitong and Wangcai. You can also check my deposit status. However, special products such as Bubuging and Huilitong lack detailed introduction. After clicking on the products, they will directly enter the product signing interface. In terms of loans, the App "Loan Zone" has launched fast loans, small and micro fast loans, farmers’ fast loans, pledged fast loans, Sino-German housing savings, and e-loans, etc., and you can query records, quotas, and liquidated consumer loans.

As for credit cards, China Construction Bank App has a "credit card" channel, which supports not only card services such as card application, activation and loss reporting, but also account services such as audit, repayment and installment, and can also check points, redeem points and use rights. However, integral mall and other functions are not convenient.

In terms of payment services, the "+"channel of China Construction Bank App can find the scanning, payment code/receipt code, which supports setting small amount of confidentiality/adding desktop shortcut, but does not support querying related payment records for the time being. It is worth noting that "All Applications → Account → Payment Records Query" can query the payment records before 7 days, and "Long Payment → Transaction Records" can view the transaction records of Long Payment.

In terms of network services, the App "Network Services" applet supports network query, numbering and reservation (cancelable). In addition, it also supports scanning code deposit and withdrawal, ATM card swallowing error inquiry, etc.

In terms of life service, China Construction Bank App has a "Enjoy Life" channel, which provides various life payment such as telephone recharge, water, electricity and gas charges, and supports government services such as electronic social security cards and medical insurance cards, as well as convenient services such as party membership fees. In addition, the App provides scene services such as food and entertainment, car owner service, medical health, business travel service and school education by accessing third-party applications. In addition, App provides services such as good business and building a home. It is worth noting that there are a large number of "micro-applications", covering many scenes such as travel, food, convenience, finance, games, etc., but some of them are messy. For example, there are many channels for "mobile phone recharge", and the convenience and preferential strength of functions are different.

Compared with last year’s evaluation, the functions of China Construction Bank’s App such as transfer and remittance have been optimized, with a full range of investment products and rich micro-applications. However, many functional details are not handled in place, especially the handling of funds in transit needs to be optimized; In addition, the number of micro-applications is large but somewhat messy, and it is still necessary to find a breakthrough.

Performance safety (10.60 points /15 points):

Performance security includes basic security settings, privacy protection, performance testing and security testing.

In terms of basic security settings, China Construction Bank App has an independent security keyboard, which will automatically exit when logging in overtime, and multiple wrong passwords will trigger account freezing; Support to query the recent login log, manage the login device, and set the screen capture/recording prevention for key transaction pages.

In terms of privacy protection, the China Construction Bank App opened the explicit privacy policy for the first time, indicating the release and effective date of the privacy policy, as well as the ways to inquire, correct and delete personal information, as well as the user’s complaint channels, feedback mechanisms and cancellation channels. It is worth noting that the App supports opening/closing personalized advertisements, and does not support third-party authorization management for the time being. The compliance evaluation report provided by Sina Financial Evaluation Office’s technical support "Love Encryption" shows that China Construction Bank App has many non-compliance in five tests.

In terms of performance testing, the data provided by "Borui Data", the technical support of Sina Financial Evaluation Office, shows that the average response degree of the audit and wealth management pages of China Construction Bank App is slightly worse than the industry average.

In terms of security detection, the manual penetration report provided by the technical support "Security" of Sina Financial Evaluation Room shows that the IOS client of China Construction Bank detected a low-risk point among 12 vulnerabilities in 8 categories.

Innovation and development (7.725 points /10 points):

Innovation and development mainly consider three aspects: aging development, multi-channel development, App development and innovation.

The semi-annual report of China Construction Bank in 2021 pointed out that version 5.0 of personal mobile banking was officially released, which used the cutting-edge technology of financial technology to innovate the functions of intelligent voice, intelligent search and intelligent recommendation, so as to provide customers with brand-new visual feelings and experiences and share better mobile financial intelligent services.

From the perspective of aging development, China Construction Bank launched the "caring mode", and the overall framework was designed to be aging-friendly: the bottom column was divided into two channels: "Home Page" and "My", and the voice service was set in the center. Users can quickly find the entrance of audit, transfer and payment, and the operation journey is designed to be aging; On-line pension services such as provident fund, medical insurance card and enterprise annuity, and also provide information reading; Outlets can navigate and make reservations, customer service can make direct calls, and voice service is also good.

From the perspective of multi-channel development, WeChat official account, the "China Construction Bank", provides services in three sections: micro-finance, yue life and credit card, and supports audit, account reminder and manual customer service, etc. It has also launched an account manager cloud studio and a business processing hall. In terms of small program services, it provides "China Construction Bank Micro-Banking" and small programs, and supports services such as audit and network appointment.

From the development and innovation of App, the App of China Construction Bank has been upgraded to version 5.0, and the structure of five channels has been reconstructed. AI mobile banking is innovative. From the perspective of user experience, search and customer service have been greatly improved, but there is room for improvement in registration, login and message center, and some interactive levels are not sufficiently differentiated and prompted; From the perspective of product functions, functions such as App transfer and remittance have been optimized, micro-applications are rich but somewhat messy, and many functional details are not handled in place. On the whole, the App of China Construction Bank has changed a lot compared with previous years, but it still needs to focus on its core functions, develop to be "refined" and find a breakthrough.

(The test version is IOS version 5.5.9.001 and Android version 5.5.9. The privacy data is provided by Ai Encryption, the performance test data is provided by Borui Data, and the security test data is provided by Bangbang Security. The evaluation deadline is December 17, 2021.)

This year is the eighth year of the establishment of Sina Financial Evaluation Room. In the past eight years, we have participated in and witnessed every step of the development of bank App! Since last year, Sina Financial Evaluation Office has joined the evaluation of "Mobile Banking App", combined with the new trend of industry development, discussed and deliberated with industry experts in depth, formulated the evaluation standard of mobile banking App, and introduced third-party technical institutions to give data support, striving for professionalism, objectivity and fairness.

After several rounds of tests, such as initial test, retest and cross-evaluation, the financial evaluation room comprehensively scans the mobile banking apps of 23 banks in four dimensions: user experience, product functions, performance and safety, and innovation and development, with more than 250 sub-indicators.

关于作者